Definition of long-term loans.

Using long-term loan can be an advantage in business. However, if such credit is not applicable consumed, but can also be a big problem. The newly established company rule, there can only be short-term debt. After a few years of business by a bank approved a long-term loan.

Long-term loan is the loan that is due and payable after one or more years. Long-term loan is defined as debt capital. Together with the equity consists of total capital available to the firm. Capital structure tells how the company long-term funding. So what is the ratio of equity to total capital and what proportion of long-term debt capital in the total capital.

Long-term loan is the loan that is due and payable after one or more years. Long-term loan is defined as debt capital. Together with the equity consists of total capital available to the firm. Capital structure tells how the company long-term funding. So what is the ratio of equity to total capital and what proportion of long-term debt capital in the total capital.

Loan Amortization Schedule

Calculation annuity

Calculation annuity

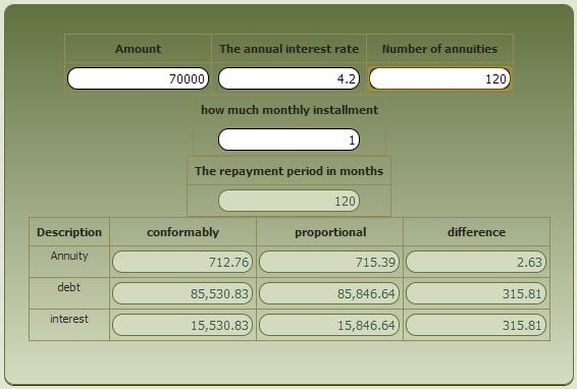

It is usually prepared in tabular form showing the repayment of the loan repayment period through the capitalization periods. For each capitalization period is calculated interest repayment and the rest of the loan principal. For this calculation you need the annuity payment calculator. Of the capitalization period is dependent on the dynamics of repayment or frequency of repayments, for example, monthly, quarterly, semi- annually.

Impact of financing long-term loans to business

Higher interest costs resulting from large-scale financing businesses with long-term credit , more sensitive to changes in the total profits of the change in operating profit , or increase the leverage ratio .

Credit conditions imposed by creditors often have a major impact on business . Thus, creditors may impose conditions such as: the limit on indebtedness , intermittent account restrictions on the disposal of profits and payment of dividends . Agreed credit terms after the contract is very difficult to change , so they negotiate with creditors is very important.

Credit conditions imposed by creditors often have a major impact on business . Thus, creditors may impose conditions such as: the limit on indebtedness , intermittent account restrictions on the disposal of profits and payment of dividends . Agreed credit terms after the contract is very difficult to change , so they negotiate with creditors is very important.